Accounting is an essential function for any business, but it can often be tedious and time-consuming.

However, with the advancements of artificial intelligence (AI) in recent years, accountants now have AI Tools for accounting that can significantly boost efficiency and accuracy in their work.

Whether you're a freelancer juggling multiple clients or a CFO looking to streamline enterprise-level financial processes, this guide is your doorway to a smarter way of working.

In this Blog, We'll explore what to look for in an AI accounting tool and introduce you to 7 leading AI Tools for accounting, each promising to transform your accounting world.

Understanding AI in Accounting

AI Tools for accounting are revolutionizing the accounting industry by improving efficiency, accuracy, and decision-making processes. It enables accountants to focus on strategic planning and advisory roles, adding more value to clients and organizations.

How can AI tools improve the accuracy and efficiency of accounting processes?

AI tools for accounting can improve accuracy and efficiency by automating repetitive tasks like data entry and reconciliation, reducing human error. They can also analyze large amounts of financial transactions , identify patterns or anomalies, and provide real-time insights for better decision-making.

Considerations When Choosing AI Tools for accounting

- Task Assessment: Identify time-consuming or error-prone accounting tasks.

- Seamless Integration: AI Tools for accounting ensure easy integration with existing software, user-friendly interface.

- Provider Credibility: Check provider's reputation, reviews, and expert endorsements.

- Cost-Benefit Analysis: Evaluate pricing, support, and expected return on investment (ROI) for the AI tool.

1.Vic.ai

Vic.ai is an AI accounting software designed to automate and enhance the efficiency of accounting and finance processes. It focuses on autonomously processing invoices and optimizing accounts payable workflows. The tool integrates with major ERP systems and leverages advanced AI to minimize manual works.

How Vic.AI Works

Vic.ai ingests invoice data from various sources like PDFs and emails, utilizing proprietary computer vision for data extraction. The AI reviews invoice data, predicts necessary information, and automates coding and approval workflows. It integrates with ERP systems to streamline accounts payable processes and decision-making.

Key Features

- Autonomous Invoice Processing: Utilizes AI for automated invoice data extraction and coding.

- Compatibility with Major ERP Systems: Integrates seamlessly with various ERP systems.

- Hands-Free Coding: AI-driven prediction of invoice information and automatic data handling.

- Automated Approvals and Payments: Routes invoices for approval or direct payment based on AI confidence levels.

- Real-Time Accounting: Streamlines transactional and cost-side accounting tasks autonomously.

- Error Reduction: Minimizes manual errors in invoice processing and general ledger allocation.

- Time and Cost Efficiency: Accelerates invoice processing, reducing manual effort and operational costs.

Limitations

- Occasional issues with duplicate invoice detection.

- Challenges in pulling specific reports.

- Some tools within the platform may feel clunky and need improvement.

- Direct API integration with certain ERP systems, like PeopleSoft, is not yet available.

User Feedback

G2:4.8 out of 5

Users generally appreciate the AI-driven automation, efficiency, and ease of use provided by Vic.ai.

Positive aspects highlighted include time savings, cash flow forecasting , detailed receipt review, and the platform's ability to learn and improve over time.

Criticisms include occasional difficulties with email notifications, challenges in report generation, and some interface usability issues.

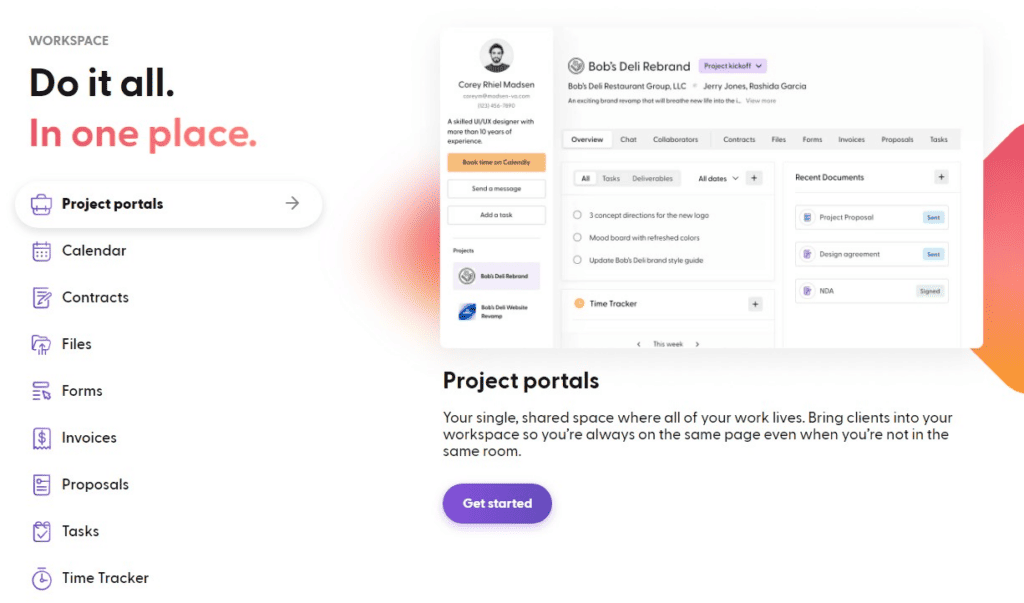

2.Indy

Indy is a comprehensive AI tools for accounting designed for freelancers to manage their business processes, including proposals, contracts, invoicing, and client collaboration. It offers a free plan with essential features and a Pro version for expanded capabilities. The platform emphasizes ease of use, integration, and efficiency in handling business tasks.

How Indy Works

Indy provides a centralized workspace where freelancers can manage projects, track time, and handle documents like contracts and invoices. The platform facilitates client collaboration through integrated chat and commenting systems. It streamlines task management, file sharing, and proposal and invoice creation within a single interface.

Key Features

- Project Workspaces: Dedicated areas for each project, including tasks, files, and essential paperwork.

- Proposals, Contracts, and Invoices: Access to over 100 templates for various freelance jobs, with easy customization and sending capabilities.

- Advanced File Sharing: Offers significant storage space (10 GB on the free plan, 1 TB on the paid plan) and version tracking for files.

- Client-Facing Collaboration: Built-in chat for real-time communication, allowing clients to review and approve work without creating an account.

- Intuitive Form Builder: Drag-and-drop functionality for creating customized forms for client inquiries and feedback.

- Automated Time Tracking: Built-in time tracking on every screen, with manual time entry options and detailed reporting.

- Responsive Development Team: Actively incorporates user feedback into regular updates and new features.

Limitations

- Limited invoicing features compared to similar services.

- Mobile app experience is challenging and lacks certain functionalities.

- Limited project management capabilities without advanced features like Gantt charts or task dependencies.

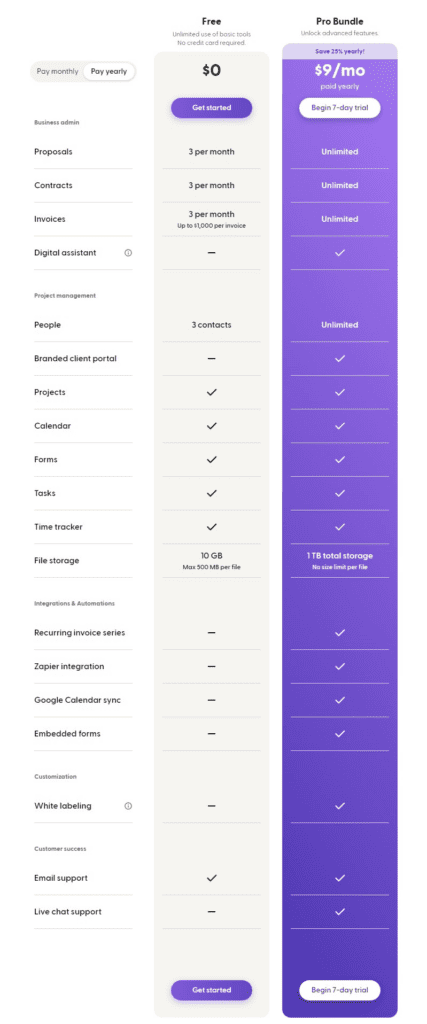

Pricing

- Free Plan: Allows up to three proposals, contracts, and invoices each month, with a cap of three active clients and $1,000 invoicing at a time.

- Pro Bundle: Priced at $9 per month, offering unlimited access to all features including proposals, contracts, invoices, clients, projects, automations, live chat support, and 1 TB of storage.

User Feedback

Capterra: 4.7out of 5

Users love the simplicity and ease of Indy for creating contracts, proposals, and managing invoices. The platform offers good value for money with responsive customer support. However, some users want more advanced features like enhanced automation, improved mobile experience, and full custom branding. Indy is highly recommended for freelancers and small business owners, especially those starting out or with fewer clients.

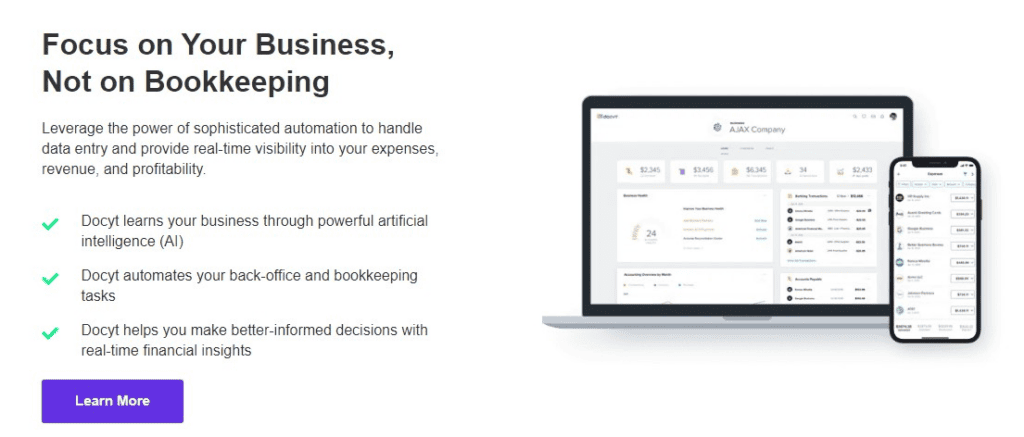

3.Docyt

Docyt is one of of the best AI Tools for accounting for back-office operations, designed to streamline data entry and provide real-time financial insights.

It automates tasks such as bookkeeping, multi-entity accounting, and vendor tax compliance, offering businesses a comprehensive view of their expense reports, revenue, and profitability.

Docyt integrates with various platforms, including POS systems, accounting software, and ERP systems like QuickBooks, NetSuite, and Xero.With cloud-based collaboration tools and integrations, Docyt simplifies complex financial operations, enabling informed decision-making.

How It Works

- Collect: Gathers data like bank feeds, receipts, and integrates with other systems.

- Organize: Extracts and organizes data into actionable workflows.

- Act: Facilitates quick business management tasks.

- Reconcile: Offers continuous reconciliation of accounting software with real-time insights.

- Adapt: Provides insights for making strategic business adjustments.

Key Features

- Automated Back-Office Tasks: Streamlining bookkeeping and financial workflows.

- Real-Time Financial Insights: For expenses and profitability analysis.

- Multi-Entity Accounting: Catering to different business locations.

- Automated Bank Reconciliation: With live bank feed integration.

- Vendor Tax Compliance and Reporting: Including 1099 forms.

- Cloud-Based Collaboration: Facilitating team coordination.

- Employee Expense Reimbursement: Streamlining the process.

- Automated Receipt Capture: For efficient record-keeping.

- Employee Credit Card Management: For controlled expenses.

- Role-Based Access Controls: Enhancing security and privacy.

Limitations

- Some users reported challenges in dealing with offshore resources and unclear phone/Google connections.

- There have been instances of frustration with repetitive tasks and the need for frequent clarifications and corrections.

Pricing

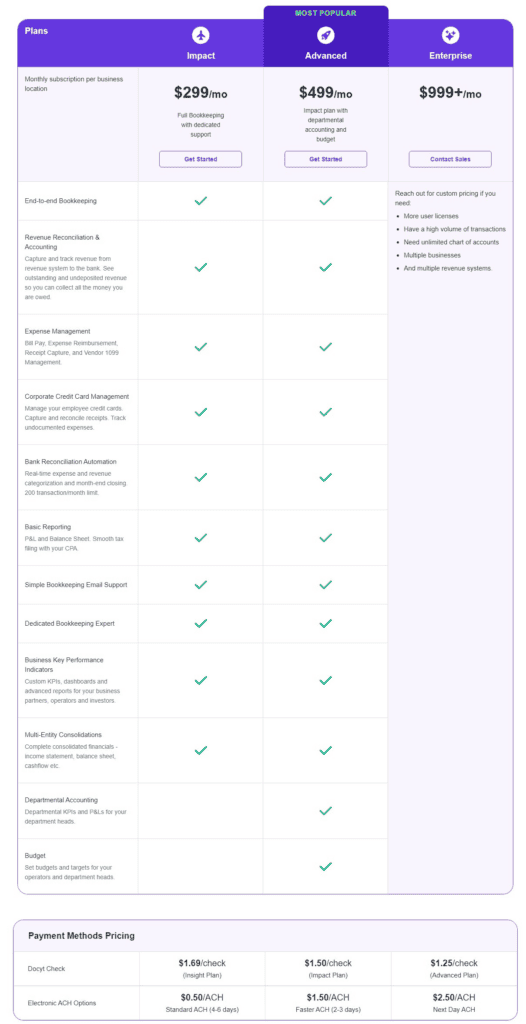

- Impact Plan: $299/month for full bookkeeping with dedicated support.

- Advanced Plan: $499/month, includes everything in Impact plus additional features.

- Enterprise Plan: Starting at $999/month, customizable for larger needs.

- Payment methods vary by plan, with checks ranging from $1.25 to $1.69 per check, and ACH transfers costing between $0.50 and $2.50 depending on speed.

User Feedback

Capterra :4.5/5 based on 38 reviews.

Docyt is praised for its user-friendly interface and secure mobile access, making it a convenient and safe choice for on-the-go financial management. It also saves time in managing accounting and budgeting tasks and offers good customer support. However, some users find the pricing high. There are also occasional responsiveness issues and challenges in support, particularly with offshore resources.

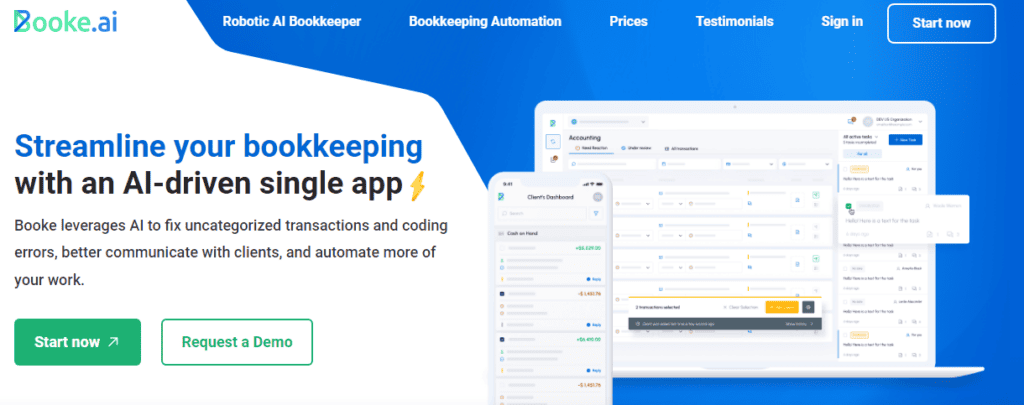

4.Booke AI

Booke AI is an AI-powered automation tool aimed at simplifying bookkeeping for accountants.

It offers features like auto-categorization of transactions, real-time OCR data extraction, and seamless integration with accounting software.

The tool is designed to enhance efficiency, accuracy, and client communication in bookkeeping tasks.

How It Works

- Booke AI automates transaction categorization and reconciliation with AI assistance.

- It provides real-time OCR for extracting data from invoices, bills, and receipts.

- The tool supports two-way integrations with popular accounting software like Xero and QuickBooks, facilitating data syncing and workflow streamlining.

Key Features

- Auto-Categorization: Classifies transactions with AI assistance.

- Real-Time OCR Extraction: Efficient data extraction from financial documents.

- Software Integration: Compatible with Xero, QBO, and QBD.

- Communication Tools: Enhances client communication and collaboration.

- Bulk Document Management: Manages documents efficiently.

- Discrepancy Detection: Identifies and resolves discrepancies.

- Interactive Reports: Generates detailed financial reports.

- Error Detection Technology: Ensures accuracy in bookkeeping.

- User-Friendly Portal: Simplifies user interaction and data management.

- Performance Dashboard: Provides insights and analytics.

Limitations

- Limited integration with accounting software beyond Xero, QBO, and QBD.

- Requires Chrome for certain extensions and lacks a mobile application.

- Error detection is not entirely foolproof and lacks multi-currency support.

- No API availability and no offline mode, potentially overwhelming for some users.

- Limited support channels and no direct bank feeds.

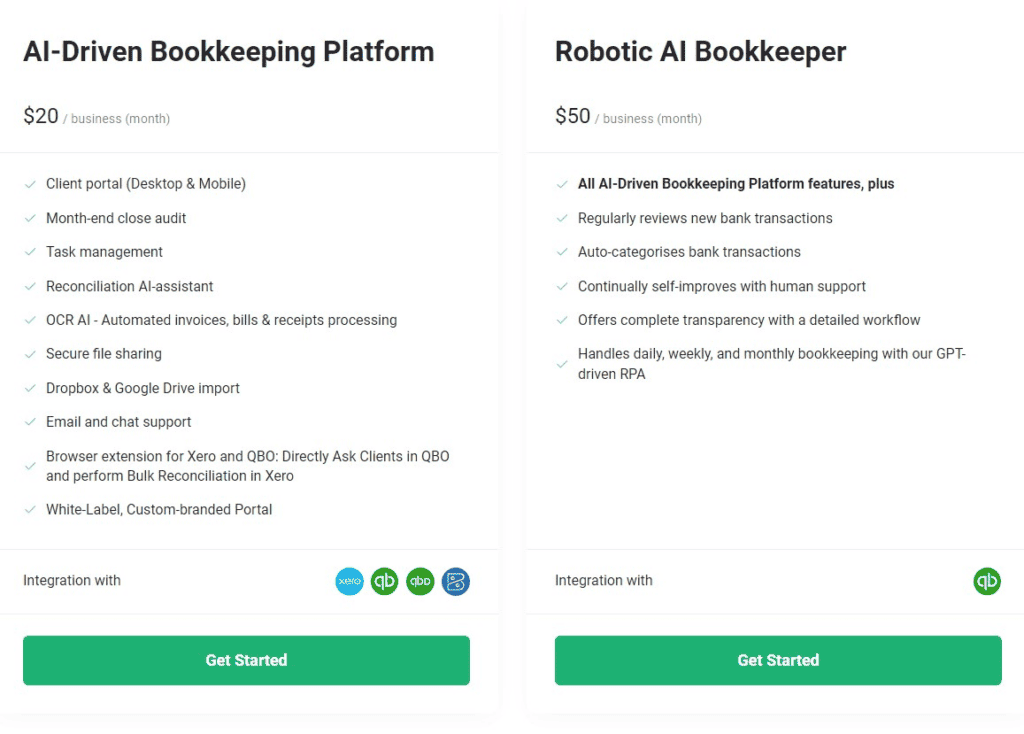

Pricing

- AI-Driven Bookkeeping Platform: $20/month per business for various features including a client portal, month-end audit, task management, and integrations with accounting software.

- Robotic AI Bookkeeper: $50/month per business, includes all features of the AI-Driven platform plus advanced services like auto-categorization of transactions and GPT-driven RPA for comprehensive bookkeeping.

User Feedback

Users praised the tool for its speed, accuracy, and ease of use, but noted its recent entry into the market and potential reliability issues.

For accountants, business owners, and financial professionals seeking to streamline their bookkeeping process, Booke AI presents a promising solution.

5.Truewind

Truewind is an AI-powered bookkeeping and finance tool specifically designed for startups, offers customizable dashboards for tracking performance metrics.It combines AI technology with concierge service to provide accurate bookkeeping, financial models, and fast monthly closes.

The platform aims to simplify back-office finance processes and enhance financial management for startups.

How It Works

Truewind utilizes AI to deliver precise bookkeeping services and detailed financial models.It aids in financial planning and investor management, aligning with startups' growth goals and expense targets.The platform provides fast book closures and generates financial reports, ensuring transparency and aiding decision-making.

Key Features

- AI-Powered Bookkeeping: Ensures accuracy and reliability in maintaining financial records.

- Detailed Financial Models: Assists in forecasting and strategic decision-making.

- Investor Management: Streamlines investor relations and communication.

- Financial Planning: Helps develop comprehensive financial plans.

- Financial Reporting: Generates tailored financial reports for startups.

- Fast Book Closures: Enables swift closing of books for timely business decisions.

- Concierge Support: Offers expert assistance in managing books, taxes, and financial needs.

Pricing

Truewind operates on a paid pricing model, with monthly and yearly subscriptions tailored to your expenses and business needs.

To understand its suitability for your startup and to get detailed pricing, it's recommended to reach out to Truewind directly.

User Feedback

Users highlight its effectiveness in handling back-office finance operations, enabling businesses to grow without needing additional finance hires. Clients appreciate Truewind's proficiency in bookkeeping and report generation, praising its detailed financial modeling and fast book closure times.

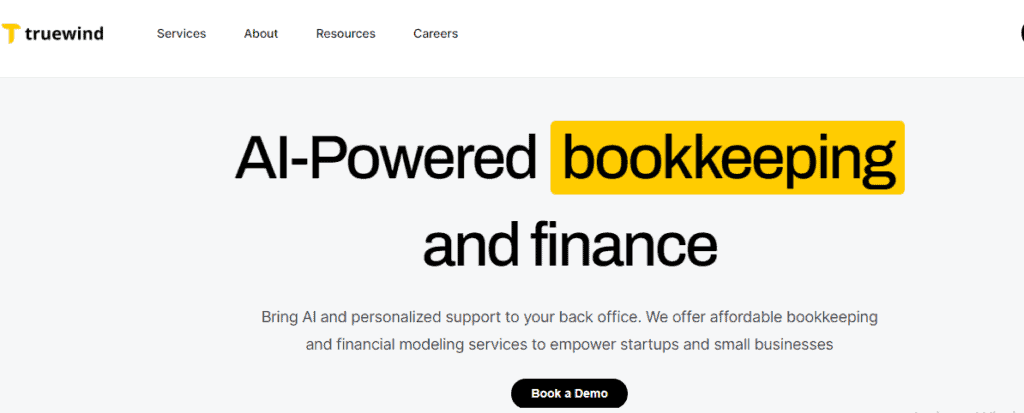

6.Gridlex

Gridlex is a comprehensive collection of business tools, which incorporates Gridlex Sky.

Gridlex Sky is a versatile accounting, expense management, and ERP software.

It offers a range of automated features for financial management, including revenue, expenses, and profitability calculations.

The tool is highly customizable, catering to various accounting and business management needs.

How It Works

- Gridlex Sky improvises financial performance by reducing manual work and the risk of errors.

- It provides features for managing expenses, receipts, and claims, streamlining administrative processes.

- The software supports multi-currency transactions and offers inventory management with real-time visibility.

Key Features

- AI Advisor: Offers AI-driven insights and advice.

- Revenue Management: Automates and manages revenue-related calculations.

- Inventory Management: Efficiently tracks and manages inventory levels.

- Chart of Accounts (COA): Simplifies account management.

- Vendor Management: Streamlines vendor interactions and transactions.

- Banking Feed Reconciliation: Facilitates accurate financial tracking.

- General Ledger Management: Organizes and maintains financial records.

- Integrated Payroll: Manages payroll processes within the system.

- Integrated CRM: Combines customer relationship management features.

- Expense Management: Automates expense approvals and reimbursements.

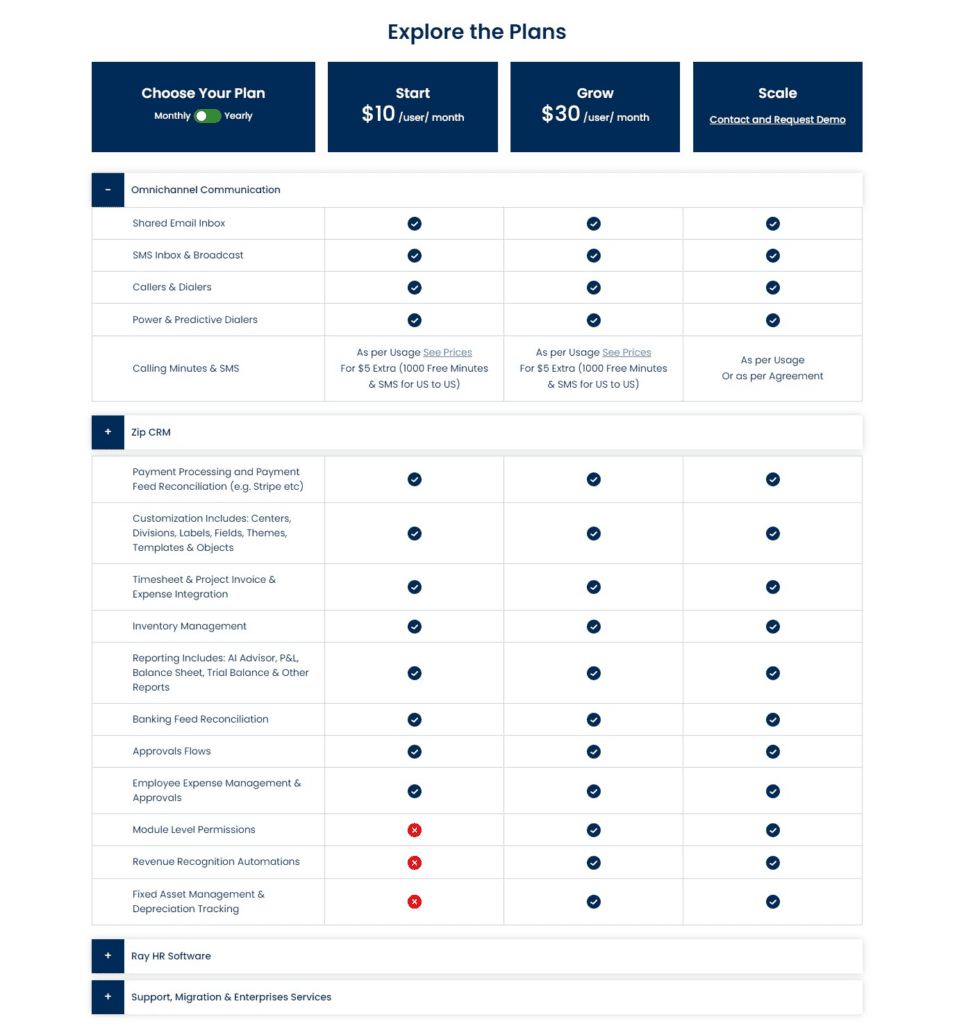

Pricing

- Start Plan ($10/user/month): Ideal for small teams seeking core omnichannel communication with shared email and SMS inboxes, basic CRM features, and essential financial reporting.

- Grow Plan ($30/user/month): Best for growing businesses that need advanced CRM customization, full inventory management, and comprehensive financial reporting, along with omnichannel communication.

- Scale Plan: Customized solution for scaling enterprises requiring extensive CRM and financial management features, advanced reporting, and personalized support services—contact for a tailored package.

7. Zeni.ai

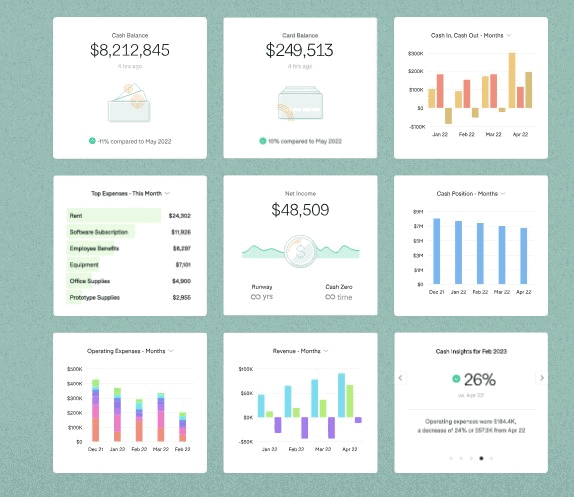

Zeni.ai is designed to streamline the financial operations of startups, moving beyond traditional accounting and bookkeeping. It provides a unified platform for managing finance operations, offering AI-driven insights and real-time data updates.

How It Works

Zeni leverages AI to automate and harmonize financial data, enabling real-time, AI-driven insights and data-driven decision-making. It functions collaboratively with real finance experts for efficient management of bookkeeping and financial functions.

Key Features

- Automated Bookkeeping: Daily reconciliation and real-time financial updates.

- CPA Oversight: Expert team overseeing and correcting financial records.

- Tax Services: Includes tax filing and R&D tax credit calculation.

- Real-Time Dashboard: Updated daily for constant financial visibility.

- Financial Expertise: Access to bookkeepers, accountants, CPAs, tax experts, and fractional CFOs.

- Vendor Payment Automation: Streamlines payment processes with AI assistance.

Limitations

While Zeni offers comprehensive financial services, it does not cover all aspects of financial management, such as sales tax handling, and might be more suited for tech startups rather than diverse business models.

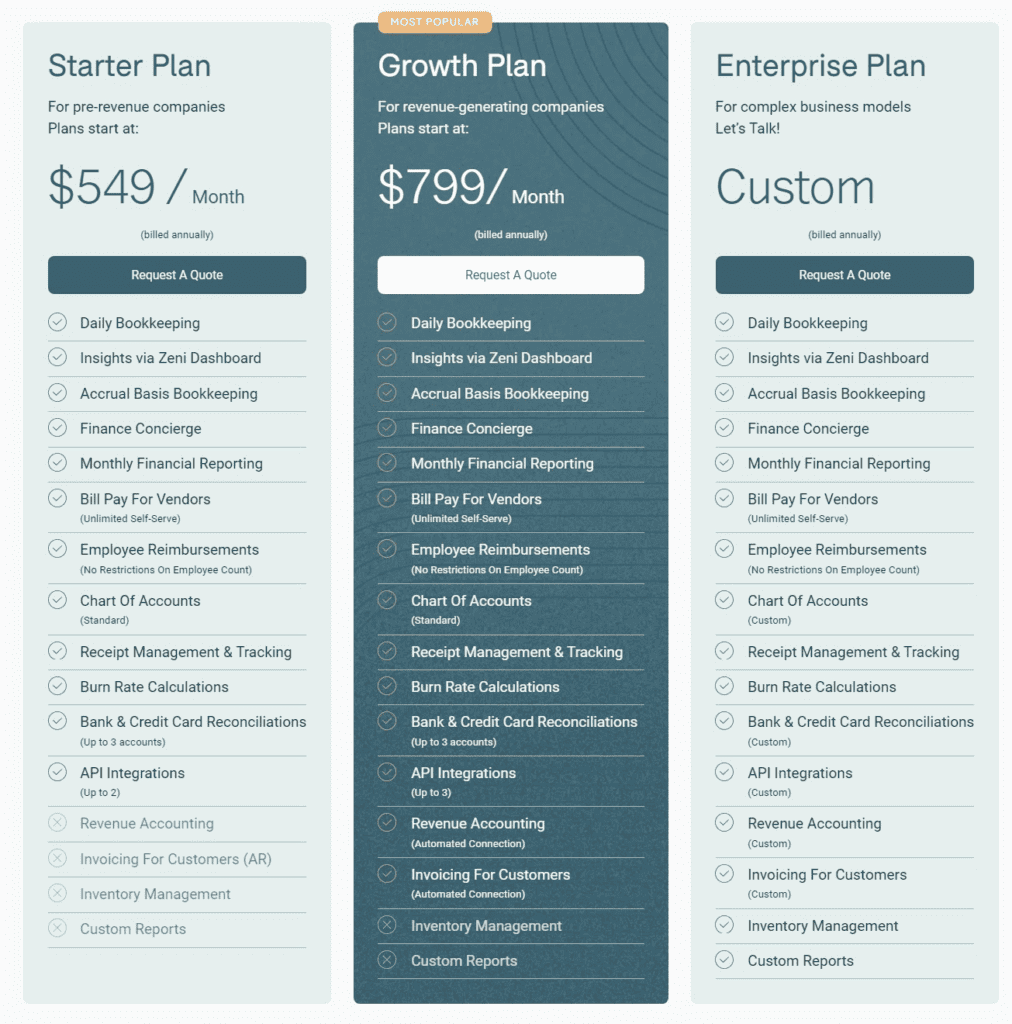

Pricing

- Starter Plan: For pre-revenue companies, starting at $549/month (billed annually).

- Growth Plan: For revenue-generating companies, starting at $799/month (billed annually).

- Enterprise Plan: Custom pricing for complex business models, details provided upon request.

User Feedback

G2 User Rating: 4.7 out 5

Users appreciate Zeni for its automatic bookkeeping, real-time financial updates, and ease of use, especially for financial presentations and board meetings. Users have reported significant time savings and improved financial management efficiency.

Conclusion

AI tools for accounting have revolutionized the accounting industry by streamlining tedious tasks, improving accuracy, and enhancing efficiency. These AI tools for accounting offer benefits such as enhanced data analysis, improved risk management, and simplified complex accounting tasks. When choosing an AI tool, it is important to evaluate features, consider user interface and pricing, and read reviews.

In this blog, we have discussed the top 7 AI tools for accounting Vic.ai, Indy, Docyt, Booke AI, Truewind, Gridlex Sky, and Zeni.ai. Each of these AI tools for accounting offers unique capabilities to cater to different accounting needs.

Elevate your accounting game with AI. Explore these top seven AI tools for accounting and embrace the future of finance today!

Looking to enhance your productivity with AI?

Explore our wealth of resources and find the best AI tools for your needs with our top suggestions on AI email writers, essay writers, resume writers, and many more in our expertly curated blog articles.